The question of whether the stock market rises and falls based on who occupies the White House sparks intense debate, especially around election cycles. Some argue that Republican presidents stimulate market growth, while Democrats stifle business with regulation. Others believe that presidents wield little influence over long-term market trends.

With President Trump’s current and historical approach to trade wars and protectionist policies, businesses reliant on global trade are experiencing disruptions and uncertainty.

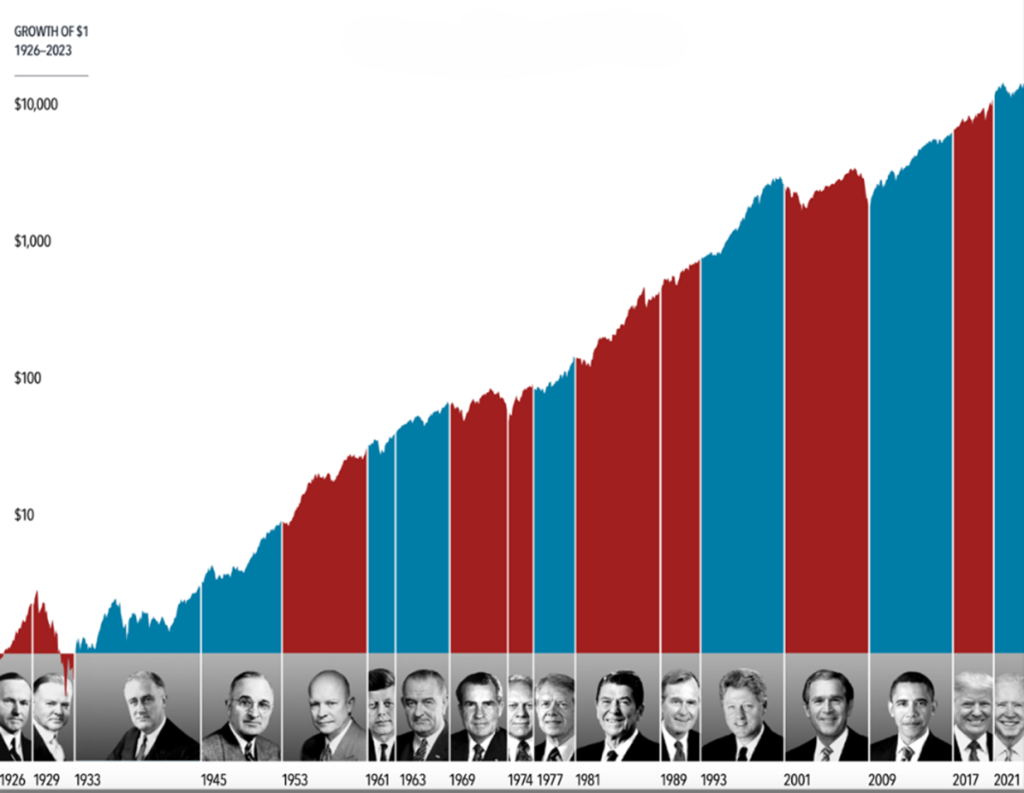

The truth, as history demonstrates, proves markets are shaped by far more than who occupies the White House. If presidential policies were the primary driver of market returns, we’d expect a consistent pattern: Republican leadership would correlate with strong markets, while Democratic administrations would see declines. However, the data tells a different story:

- George W. Bush (Republican, 2001-2009) → 3 down years, 5 up years

- Barack Obama (Democrat, 2009-2017) → 8 up years

- Donald Trump (Republican, 2017-2021) → 3 up years, 1 down year

- Joe Biden (Democrat, 2021-2025) → 3 up years, 1 down year

The idea that stock markets rise and fall based solely on the sitting U.S. president is more myth than reality. Data compiled by Dimensional, spanning nearly a century (1926-2023), shows that market growth is resilient across administrations. The long-term average remains stable, with markets typically experiencing a down year approximately once every four years, regardless of which party is in power. This points to a more fundamental truth – stock markets are primarily influenced by economic cycles, global events, and corporate performance, not partisan politics.

While markets have shown a consistent upward trend over time, short-term fluctuations are often tied to economic cycles rather than presidential policies. Although policies like tariffs, tax reforms, and stimulus packages can create temporary shifts, businesses adapt, markets self-correct, and long-term trends prevail.

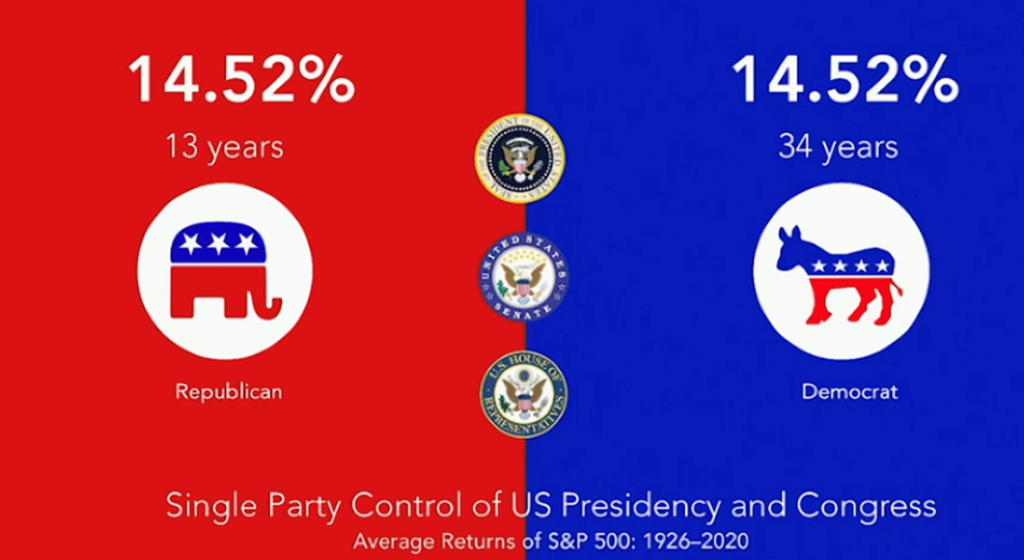

The US political system is such that the President, the Senate and Congress all share power. Could this effect be a consequence of what is known as the lame duck president where they do not have a majority in both houses. Again, the data suggests otherwise.

Analysing the Evolution of the S&P 500

From 1926 to 2020, the average annual return for the S&P 500 was 14.52% during single-party control of the U.S. presidency and Congress. Republicans held this control for 13 years, while Democrats maintained it for 34 years. Despite the difference in duration, the stock market’s performance remained the same under both parties, suggesting that the president and party control do not significantly influence long-term market returns.

Source: Dimensional 2023

Such uncertainty reflects the broader forces at play in the market. As markets behave like living organisms —constantly adapting and recalibrating based on new information, pinning volatility on a single event oversimplifies the complexity of market dynamics. Many factors, including interest rates, corporate earnings, global trade, and consumer sentiment, shape investor behaviour. Analysts at Vanguard reinforce the view that elections may grab headlines, but markets efficiently digest and “price in” political shifts long before votes are counted. Rather than reacting to the noise, markets respond to changing economic expectations, adjusting to the full spectrum of global events in real-time.

The True Drivers of Market Performance

Rather than focusing on presidential policies, investors should consider the actual forces that shape financial markets:

- Corporate Earnings and Economic Cycles

Markets move in cycles, with bull runs following recessions and corrections being inevitable. Over time, corporate profits, innovation, and productivity gains drive market performance far more than government policies. Even in periods of regulatory expansion, businesses adapt, find efficiencies, and continue to generate profits. - The Federal Reserve: The Market’s Real Power Player

While presidents propose fiscal policies, the Federal Reserve (Fed) controls monetary policy, arguably impacting stock prices more significantly. Changes in interest rates, money supply, and overall liquidity often have a greater impact on asset prices than tax cuts or government spending. For example, the 2020 market crash and its subsequent rebound were far more influenced by Fed actions than government policies. - Global Events and Trade Disruptions

Markets don’t operate in a vacuum. Wars, pandemics, supply chain disruptions, and global trade policies play a huge role in shaping economic performance, often more so than domestic politics. The 2008 financial crisis was triggered by unchecked financial leverage and subprime lending, not by a single administration. Similarly, the COVID-19 crash was the result of economic shutdowns, not a political shift. - Investor Psychology and Market Sentiment

Behavioural economics plays a huge role in stock movements. Fear, speculation, and expectations often drive short-term market swings, while fundamentals govern long-term trends. Elections create volatility, but markets tend to stabilise once the uncertainty clears. Investors who panic and sell based on election outcomes often miss major rallies.

Case Study: U.S. Steel & The Limits of Presidential Policy

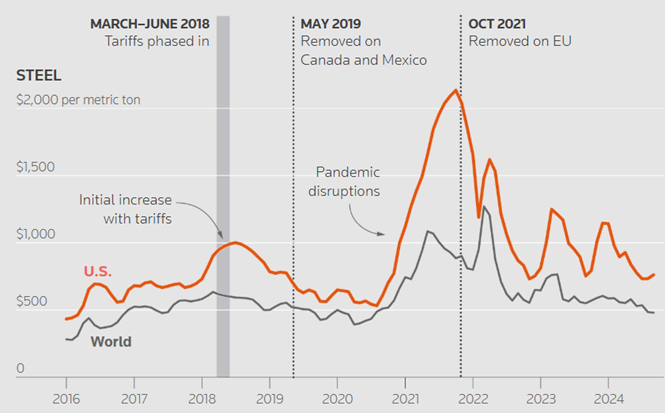

Consider the U.S. Steel Corp (NYSE: X), a notable example of the limits of presidential influence. In 2018, President Trump announced 25% steel tariffs to boost domestic production. Initially, the stock price surged, with US steel prices increasing by 5% and aluminium by 10%, reflecting investor enthusiasm for protectionist policies. However, by 2019, the stock had declined again as global demand softened and production adapted.

Source: Reuters 2025

This example shows that while Government interventions can create short-term winners and losers, markets ultimately adjust to economic realities. Businesses find ways to navigate policy shifts, ensuring survival and growth despite changing administrations.

The Takeaway: Invest in Business, Not Politics

Presidents make headlines, but they don’t dictate long-term market outcomes. Investors who focus too narrowly on politics risk missing the bigger picture—market cycles, innovation, Fed policy, and global economic forces shape financial markets far more than any administration ever could. Markets are driven by a complex web of economic fundamentals, global events, and investor sentiment, not just those who sit in the Oval Office.

Rather than reacting to political narratives, smart investors stay focused on fundamentals, diversification, and long-term growth strategies. Political policies may introduce short-term volatility, but markets, like businesses, adapt. The real key to investment success? Ignore the noise and focus on value creation.

Rutherford Rede’s Approach

At Rutherford Rede, we encourage clients to focus on the long term and maintain a disciplined investing approach. While political events are sparking short-term market volatility, our strategies are based on proven investment principles that prioritise economic fundamentals and sound financial planning. We guide clients through periods of uncertainty, ensuring their portfolios are well-positioned to weather market fluctuations and capitalise on long-term growth opportunities.

Our approach is grounded in independent, research-driven insights. We aim to empower our clients with the knowledge and strategies they need to stay calm during political upheavals and focus on what truly matters: building a secure financial future through diversified investments and strategic planning. If you want to take control of your financial journey, we’re here to help you navigate the complexities of today’s ever-changing market environment.