By all appearances, we’re in uncharted territory. Markets are volatile, headlines are breathless, and pundits are warning of systemic cracks with every downturn. The latest tariff-driven turmoil is a case in point. In March 2025, investors watched U.S. equity markets wobble as the Trump administration hinted at sweeping trade measures. Then came the blow: on April 2, the tariffs landed, larger than anyone expected. Equities dropped, oil stumbled, and panic headlines surged. But while market noise spiked, history whispered a calmer message: we’ve seen this before.

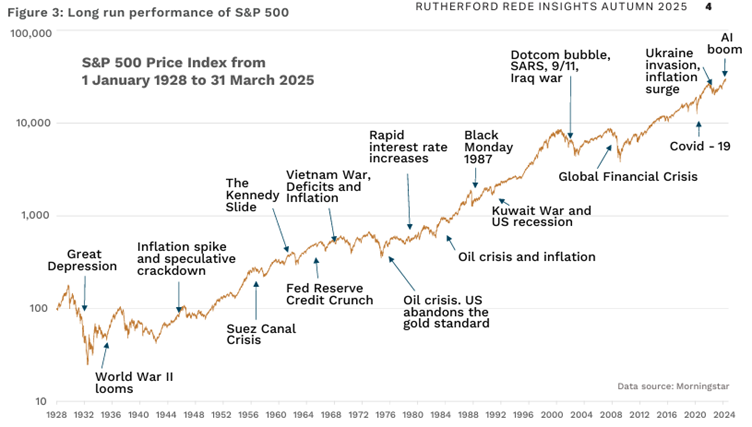

Morningstar’s data confirms this: markets have found ways to recover and grow even during periods of extreme uncertainty. Take 1942, for example. As the U.S. entered World War II, fear gripped the world, but the S&P 500 rose a short time later. Car manufacturers pivoted to building tanks and aircraft, industrial production soared, and the market steadily climbed.

Markets are forward-looking. They respond to uncertainty with volatility but always price in adaptability, reinvention, and progress.

Lessons from Recent History & Why the Present Fits the Past

Fast-forward to the Global Financial Crisis in 2008 or the COVID crash in 2020. Both sparked sharp market declines. Yet investors who stayed invested, not panicked, were rewarded. And yet, barely a year later, markets were setting new records after these critical moments of the 21st century. How? Innovation. Resilience. Monetary support. These are the same ingredients that have powered recoveries for nearly a century. The S&P 500 recovered and went on to reach new highs, driven by corporate recovery, policy responses, and the adaptability that defines capitalism.

This brings us to today. We’re seeing the same dynamic with inflation jitters and geopolitical tension dominating headlines. Volatility spikes. Confidence wavers. But fundamentally, markets reflect the forward-looking expectations of thousands of businesses and investors. And over time, that expectation is growth.

Déjà Vu with Market Twists & The Role of Diversification

At Rutherford Rede, we build portfolios that support stability through a wide range of conditions. Diversification across asset classes — equities, fixed income, international exposures, property and infrastructure — provides balance. When equity markets experience turbulence, other portfolio components often serve as counterweights.

Today’s fears centre on inflation, tariffs, and geopolitics. And they’re not unfounded. The March quarter saw New Zealand shares drop 6.2%, giving back gains from the December quarter. Australian and global equities fell 3.2 % and 2.9%, respectively. But it wasn’t all red ink. Emerging markets gained +1.8%, infrastructure delivered +3.4%, and bonds held up firmly with NZ fixed interest returning +0.7% for the quarter and +5.9% for the year. In other words, diversification did its job.

Business Agility Drives Market Strength

Markets reflect the activity of real companies solving real problems. These businesses innovate, adjust strategies, shift capital, and meet demand in evolving ways. That agility creates opportunity, and the market responds. Investors who remain invested during periods of change position themselves to benefit from this evolution. Rather than focusing on uncertainty, they align with the engines of adaptation and progress.

How to Approach the Market

Savvy investors treat volatility like the weather: inconvenient, inevitable, and rarely worth a full retreat. Success rarely belongs to the swiftest mover; it belongs to the calmest thinker. Dimensional echoes this principle, suggesting that resisting the urge to react—especially during volatile times—can be one of the most effective strategies. Doing less, they argue, can often lead to better long-term results.

So, what does that look like in practice? Here’s how to meet the market with clarity, not chaos:

- Commit to your strategy- An effective investment strategy is never accidental. It is the product of careful planning, shaped by your objectives, and stress-tested against history. It’s not designed to outperform headlines. It’s built to withstand them. Market cycles may twist the path, but a strong plan anticipates the turns and moves forward.

- Think beyond headlines – Financial media thrives on urgency. But urgency is not a reliable compass. What moves markets today may disappear from memory tomorrow. Investors anchored to their long-term goals are less likely to be pulled off course by noise. Markets fluctuate. Capital compounds. Time clarifies.

- Adopt the discipline of perspective – When volatility spikes and uncertainty dominates the narrative, perspective becomes an investor’s greatest asset. Looking back across decades of market history reveals a truth that day-to-day headlines obscure: temporary declines often create the space for lasting growth. Perspective turns discomfort into opportunity.

Rutherford Rede’s Approach

At Rutherford Rede, we believe successful investing begins not with prediction but with preparation. Our approach is defined by structure – deliberate diversification layered across geographies and asset classes. It is shaped by foresight, studying the lessons of history and the forces shaping tomorrow’s economy. And it is grounded in alignment, so every portfolio reflects the unique goals, timelines, and values of the individual behind it.

Portfolios are built to hold not just equities but bonds, global exposures, including infrastructure and property. This quarter reaffirmed why. As equity markets fell, interest rate-sensitive assets such as global bonds, listed infrastructure, and property helped stabilise overall performance.

We place process ahead of performance-chasing and consistency ahead of spectacle. This means allocating capital with intention, monitoring exposures with discipline, and communicating with clarity—especially during times of market stress. We help investors stay invested not just through market cycles but through the emotional cycles that come with them.

Whether dramatic or subdued, each market episode reinforces the same lesson: resilience is not the absence of risk but the ability to carry on intelligently in its presence. And that’s what we build for.

When others turn reactive, we turn to principle. When the noise gets louder, we double down on clarity. When the headlines declare, “This time is different,” we look at the data, revisit the plan, and stay the course. We know that the best investment outcomes rarely follow the loudest voices but rather, the most enduring strategies.

The Bottom Line

Markets will continue to fluctuate, sometimes violently. But time, not timing, remains the most powerful lever. Each significant decline was followed by years of compounding returns for investors who stayed in their seats, and this time will be no different.