Are financial advisers worth the investment? Research and practical results suggest they are. Advised clients consistently see stronger long-term returns compared to those going it alone. This article explores the “adviser gap”—the difference in outcomes for those who partner with professional financial advisers versus those who manage their investments alone.

The Numbers Don’t Lie: Adviser-Supported Returns Outperform

Research consistently shows that clients working with financial advisers achieve higher returns than self-managed investors. But these aren’t just statistics – it’s sometimes the difference between achieving a comfortable retirement and financial stress. Let’s look at some research-backed numbers to illustrate the impact of working with a financial adviser:

- The Chartered Financial Analyst (CFA) Institute reports that advised clients can potentially earn an average of 2.5% higher returns annually than their non-advised counterparts.

- Research by Vanguard indicates that financial advisers can increase their clients’ net returns by up to 3% per annum through a combination of portfolio construction, behavioural coaching, and other services.

- Similarly, Morningstar research found that sound financial planning decisions across five areas (asset allocation, withdrawal strategy, guaranteed income products, tax-efficient allocation, and portfolio optimisation) can generate an average of 29% more income for a retiree.

Let’s put this into perspective with an example. Imagine two investors, each starting with $100,000. Investor A works with a financial adviser and achieves an average annual return of 8%. Investor B goes the DIY route and manages a 6.5% average annual return. Here’s how their portfolios would look after 20 years:

- Investor A (with adviser): $466,096

- Investor B (DIY): $352,364

That’s a difference of $113,732 (32%) —more than the original investment! Let’s examine the key factors that help adviser-supported investors make smarter decisions and capture the full potential of their investments.

Understanding Our Client: The Foundation of Success

One of the primary reasons for the superior performance of advised clients lies in the adviser’s commitment to understanding each client’s unique situation. At Rutherford Rede, we believe good advisers invest considerable time in getting to know their clients, including their aspirations, fears and vulnerabilities. By taking this personalised approach, our advisers can help investors to:

- Clarify Life and Financial Goals: We help you articulate what you want from life on a personal level and understand what that requires financially. This includes both short-term and long-term objectives and defining what financial success means to you.

- Assess Risk Tolerance: We help you understand your comfort level with financial risk through in-depth conversations and sophisticated risk profiling tools.

- Identify Strategies for Success: Based on our clear understanding of your unique situation, we identify investment strategies that are most likely to help you achieve your desired financial outcomes. We don’t just offer choices—we explain how each strategy fits with your specific aspirations and risk tolerance.

- Educate and Partner with You: We equip you with a clear understanding of how investment markets operate, ensuring your expectations are realistic. We offer a steady hand during inevitable market downturns, as selling at the wrong time is one of investors’ most frequent and costly mistakes. Our goal is to help you avoid costly pitfalls and stay on track toward your financial goals.

This deep understanding forms the foundation of a tailored investment strategy that optimises returns and resonates with your personal values and life objectives.

Leveraging Tax Advantages: A Key Benefit of Professional Advice

One of the key areas where financial advisers add value is by applying tax-efficient strategies to boost clients’ after-tax returns, often widening the gap between advised and non-advised investors.

At Rutherford Rede, we frequently leverage Portfolio Investment Entities (PIE funds) to enhance after-tax performance. By strategically incorporating PIE funds into portfolios, we can often reduce our clients’ effective tax rates compared to direct investments, significantly improving overall returns.

Navigating with A Broader Perspective

Investing without professional advice is like navigating a ship without a map. You might stay afloat, but you’ll likely miss the best routes and encounter hidden obstacles.

Without professional advice, DIY investors often make short-sighted decisions, based on what they can see in front of them. Financial advisers provide a broader perspective, ensuring each choice fits into a long-term strategy.

When considering investment options, a self-directed investor might evaluate opportunities in isolation. This “narrow framing” can lead to chasing short-term gains, taking misaligned risks, or forfeiting potential returns. That’s where a skilled financial adviser becomes invaluable. Financial advisers provide a broader perspective, ensuring each choice fits into a long-term strategy, preventing emotional reactions and short-term thinking from derailing financial progress.

Education and Emotional Support: Empowering Clients for Success

Financial advisers play a dual role: as educators and emotional anchors. They guide clients through the complexities of financial markets and the emotional highs and lows of investing. Their value extends beyond managing investments.

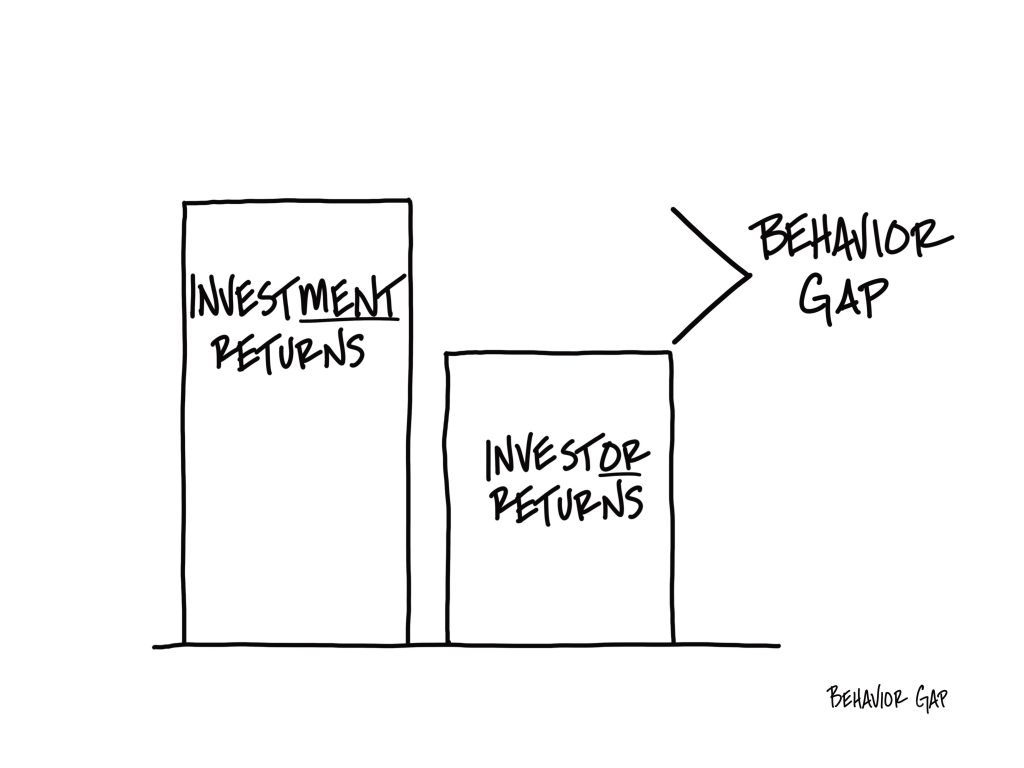

At Rutherford Rede, we recognise the importance of bridging the “behaviour gap”—the difference between an investment’s potential returns and the actual returns investors realise.

Research by Morningstar indicates that investors typically forfeit a considerable part of their potential returns due to mistimed entry and exit decisions. The consensus among analysts is that this loss is substantial and stems from counterproductive investor habits—such as yielding to fear during market slumps or pursuing recent high performers. These emotional responses can significantly erode long-term returns.

An example of this can be seen during the 2008 financial crisis. Investors who remained patient and stayed the course recovered their losses within three years, while those who sold at the market bottom took more than five years to regain their losses.

Behind the Scenes: Continuous Refinement and Due Diligence

While clients may only see their adviser periodically, much work happens behind the scenes to optimise investment performance. This ongoing management includes regular portfolio rebalancing and continuous due diligence on investment assets to ensure they meet performance expectations. These proactive efforts help keep a client’s portfolio on track.

Additionally, advisers can leverage their industry knowledge and negotiate favourable fee structures for their clients. Even small fee reductions can have a significant long-term impact, potentially saving clients thousands of dollars and materially improving their investment outcomes.

Rutherford Rede’s Approach: The Bridge to Success

At Rutherford Rede, we believe the adviser gap is more than just a statistical difference in returns— it represents a fundamental disparity in financial well-being. Our mission is to bridge that gap by offering personalised service and relentlessly focusing on our clients’ best interests.

What sets us apart is our commitment to redefining what it means to have a genuine financial partner. We go beyond merely closing the adviser gap; we transform it into a solid bridge, leading you toward a secure future. Through tailored strategies and ongoing education, we ensure that every decision aligns with your financial goals and help you avoid costly investment mistakes.

If you’re ready to see how professional, personalised financial advice can make a tangible difference in your financial journey, we invite you to schedule a consultation with one of our experienced advisers. Together, we can ensure you’re on the right side of the adviser gap.