When companies and governments issue bonds, they often seek a credit rating from an agency such as Standard &Poor’s (S&P Global Ratings). Each year Standard & Poor’s release a report looking at default rates across the various categories over time. Default is when the issuer either does not pay the regular interest payment, or even worse, fails to repay the capital back.

In the case of Standard & Poor’s, Investment grade bonds are those from rated between AAA (highest) to BBB (lowest). Anything below BBB is generally considered Speculative grade.

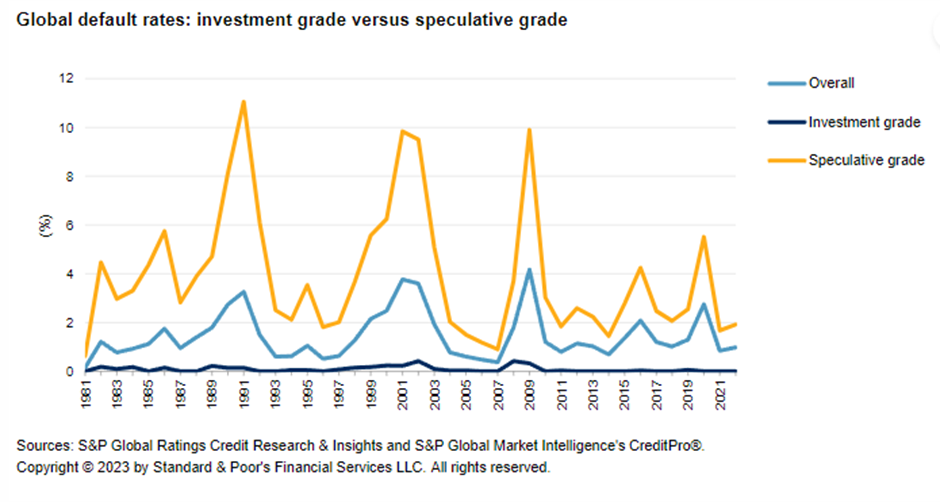

The chart below shows a significantly higher default risk for Speculative grade issues (orange line) compared to Investment grade issues (dark blue line). It doesn’t mean that some Investment grade issues haven’t (or won’t in the future) default, but the historical data suggests a significantly lower probability of default. When investing in bonds as part of a diversified investment strategy, whilst you want income from your bonds, the more important consideration is avoiding default risk.

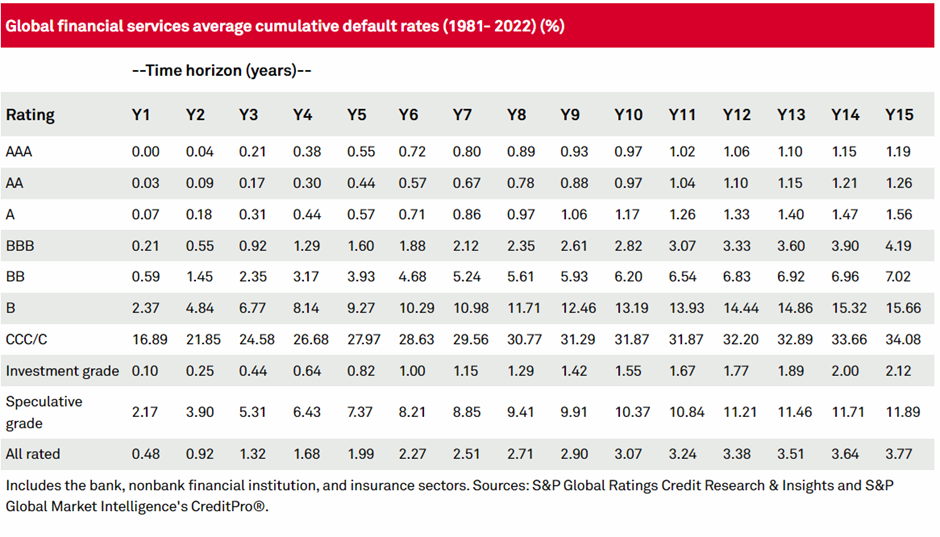

The following table illustrates default rates over a time horizon from 1 year to 15 years, with data sourced over a period of 42 years. A lot of bonds issued in New Zealand tend to be shorter dated (5-7 years at the date of issue), whereas globally they can often be for longer periods, often over 30 years. If you look at the BBB rated bonds (lowest rated investment grade bond), based on historical data, there is a 1.60% expected probability of default over a 5-year period, whereas the expected probability of default significantly increases to 9.27% for a B rated (Speculative) bond.

And across the aggregate of Investment grade bonds (AAA to BBB), the expected probability of default is 0.82% over 5 years, compared to 7.37% for Speculative grade bonds.

Therefore, know what you are getting into when buying Speculative grade bonds; whilst the yield (return) may be higher, it is so because of the higher probability of default risk. Do you really want to be taking this level of risk in what should be your safety net assets within your portfolio?

Whilst bonds do go up and down in value – in 2022 investors experienced a rapid lift in interest rates as central banks tackled stubbornly high inflation, that resulted in bonds losing value – they still play a key part as a diversifier against growth focused assets.

DISCLAIMER: Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Rutherford Rede

91 College Hill, Ponsonby

Auckland, 1011, New Zealand

Rutherford Rede © 2023. All rights reserved.