Image 1: Graph depicting Allbirds’ dramatic stock rise and subsequent fall.

Some companies experience an unbelievable surge in popularity, with their valuations increasing a hundredfold in the first few years of existence. Visualise being invested in one of those companies, valued at over $4 billion US dollars shortly after listing on the stock exchange. Now, visualise that same company seeing a staggering 96.82% dip in returns not long after. This isn’t a hypothetical scenario; this is the real story of Allbirds Inc.

Image 2: A photo of Allbirds’ Wool Runner shoes “World’s Most Comfortable Shoe.”

Founded in 2015, Allbirds quickly carved a niche for itself with its innovative wool sneaker. Endorsements from Time magazine heralding its Wool Runner as “the world’s most comfortable shoe” and the New York Times associating the brand with the Silicon Valley elite showed that Allbirds seemed poised for sustained success. However, the dramatic shift in its stock performance served as a stark reminder of the unpredictability and volatility inherent in the share market.

Diversification as a Safety Net

While the allure of potential high returns from trendy stocks is undeniable, the foundational principle of diversification in investing cannot be emphasised enough.

Risk and return share a well-established correlation in the financial landscape. Cash investments, being the safest, typically offer the lowest returns. As we move up the risk spectrum, bonds and listed shares provide increasing potential returns, balanced by higher risks. Shares, as illustrated by the Allbirds example, can be exceptionally volatile. A balanced approach, like investing across a broad spectrum of companies, allows investors to partake in the success of high-performing stocks while cushioning against potential downturns with more stable assets.

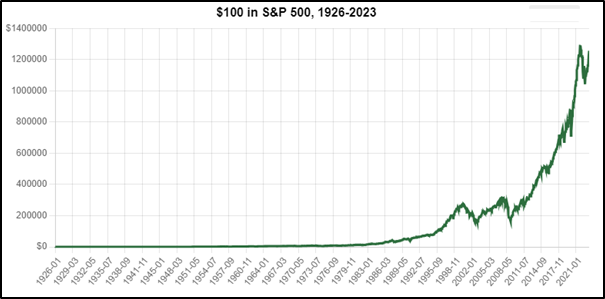

Image 3: A chart showcasing the S&P 500’s historical returns since 1926.

Reflecting on Broader Market Trends

Compared to the rollercoaster ride of individual stocks, diversified portfolios, such as the S&P 500, offer a steadier journey. Historically, since 1926, the S&P 500 has returned an average of around 10%. This showcases the power and resilience of broad-market investment strategies.

Key Takeaways:

Shock Factor in Returns: The dramatic turn of events with Allbirds’ stock highlights the unpredictable nature of the share market.

Importance of Diversification: Relying heavily on a single stock or a select few can be high-risk. Diversification helps in mitigating these risks.

Seek Professional Guidance: The market’s intricacies can be challenging to navigate alone. Consulting financial professionals can offer clarity and strategic direction.

Rutherford Rede

91 College Hill, Ponsonby

Auckland, 1011, New Zealand

Rutherford Rede © 2023. All rights reserved.