2022 was one of the worst years on record for performance in the global bond market. The Barclays U.S Aggregate Bond Index (a broad measure of the U.S. bond market) posted its worst year since records began in 1976, down 13%. Bonds typically provide a natural hedge for the volatility of shares, however in 2022 this was not the case, in fact at times bonds performed worse than shares when shares were sliding in a bear market.

So why were returns so bad, and what is the state of the bond market now?

Early in 2022 central banks all over the world started to take the threat of inflation seriously. Until then inflation had been seen as temporary, but by January 2022 central banks decided inflation had become more permanent. Therefore, interest rates needed to rise in order to bring inflation back to acceptable levels.

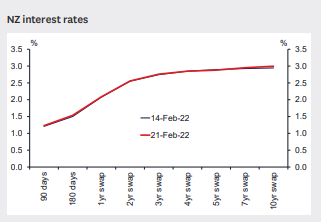

The chart below reminds us of just how low interest rates were in February 2022.

This is the New Zealand swap curve taken from the Westpac weekly economic report (subsequent charts are taken from the same source). Starting from a base of less than 1.5 %, the chart indicates that rates were expected to rise and after two years flatten off.

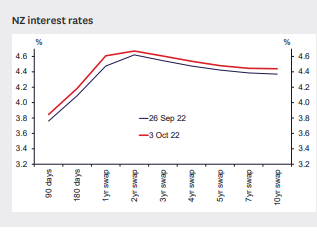

By August things had changed considerably. Inflation looked stickier, and consequently higher interest rates were expected.

By October, rates went even higher as the market’s perception of ‘transitory inflation’ started to crumble.

The speed with which rates increased throughout this time was very unusual and had significant performance implications for bonds. Each time expectations of future interest rates rose, bonds prices (whose value is based on their fixed rate of interest) fell. The good news, however, is that with rising interest rates comes higher bond yields and higher future expected returns.

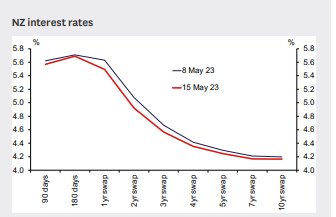

So where are we now.

Rates look very different. Prevailing expectations suggest rates will remain high for two years then decline to around 4.2%. It seems getting back to 1.5 % is not something we should expect any time soon.

Bond investors have come through one of their worst years ever, but now are enjoying some of the best returns in the last 15 years. Running yields in bond funds (that is the average cash return generated without considering capital gains or losses) are running at between 6% and 8%. These are close to the returns we expect from shares.

Those who talk of a market recovery are probably thinking about shares, and are perhaps ignoring the current unsung hero in their portfolio. Those who have a balanced approach to investing are enjoying the returns that bonds are now providing, and despite a rough journey, bonds are currently positioned better than they have been in over a decade.

Those who maintain a balanced approach to investing will know that the long term returns are the only thing that should be planned for. One bad year for bonds looks like it is to be followed by a great year. Hopefully you have not missed the bus!

Rutherford Rede

91 College Hill, Ponsonby

Auckland, 1011, New Zealand

Rutherford Rede © 2023. All rights reserved.